A year into the “new normal” and Tagum Cooperative (TC) continuously upgrades its products and services. Knowing that the society remained cooped up in their dwellings opens up an opportunity for TC to further develop the features of its very own Mobile Application and introduce more savings products such as Emergency Savings which was launched in the beginning of the year, and the mid-year release of the new SureProtect Savings or simply Suretec Savings, which focuses on saving up for annual payments of the members’ insurances.

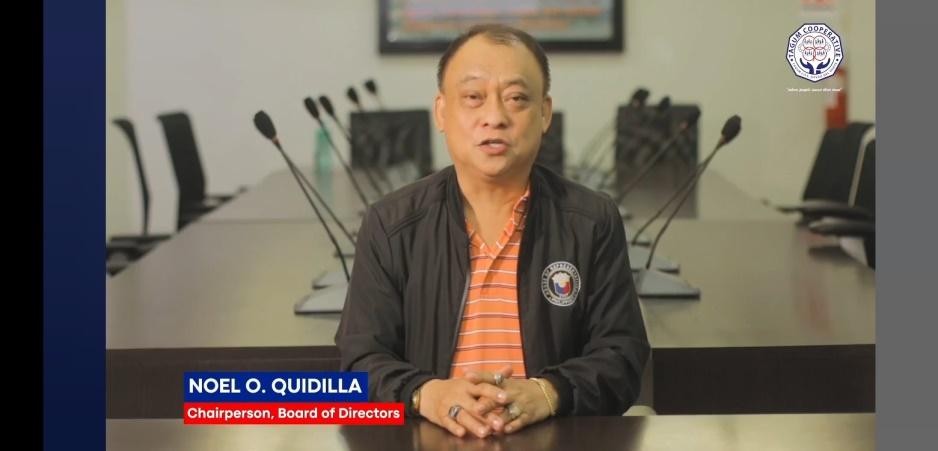

TC Chairperson Dir. Noel O. Quidilla in his statement during the launching of the new products expresses that this positive shift is timely during this global challenge. Tagum cooperative continuously strives to develop and provide high quality and member-centric programs. “This is such a rewarding day for us Tagum Cooperative as we are set to launch the new products and services that will further provide convenience and safety to all of you our valued members. We are proud to introduce our new products and services and digital enhancements this month of May.” Dir. Quidilla further states.

TC MOBILE APP

TC’s very own Mobile Application (TC Mobile App) has come a long way from real-time inquiries on ATM deposits and savings deposits to bills payment such as electric utilities, water utilities, internet, and telecommunications, to fund transfer to other TC Accounts. Now, TC Mobile App introduces its fund transfer feature to other banks, loans and insurance payment, loan renewals and Youth Member registration. These exciting upgrades are made available thanks to TC’s adept team of personnel from its Information Communication Technology Department.

To avail of these top-notch features, members may download the TC Mobile App available on PlayStore for Android devices and App Store for iOS devices.

SURETEC SAVINGS

Meanwhile, the SureProtect or simply Suretec Savings helps members prepare for their insurance renewals, this way they can pay for their insurances by saving up for the annual payments. SureTec Savings ensures continuous insurance coverage through a compulsory opening when they apply for a loan. This offers the renewal of insurance in an affordable installment scheme. Payment can be arranged through Tagum Coop’s another service, the Automatic Debit Arrangement (ADA) which gives way for a hassle-free payment. This will encourage members to pay annual premium on or before due date.

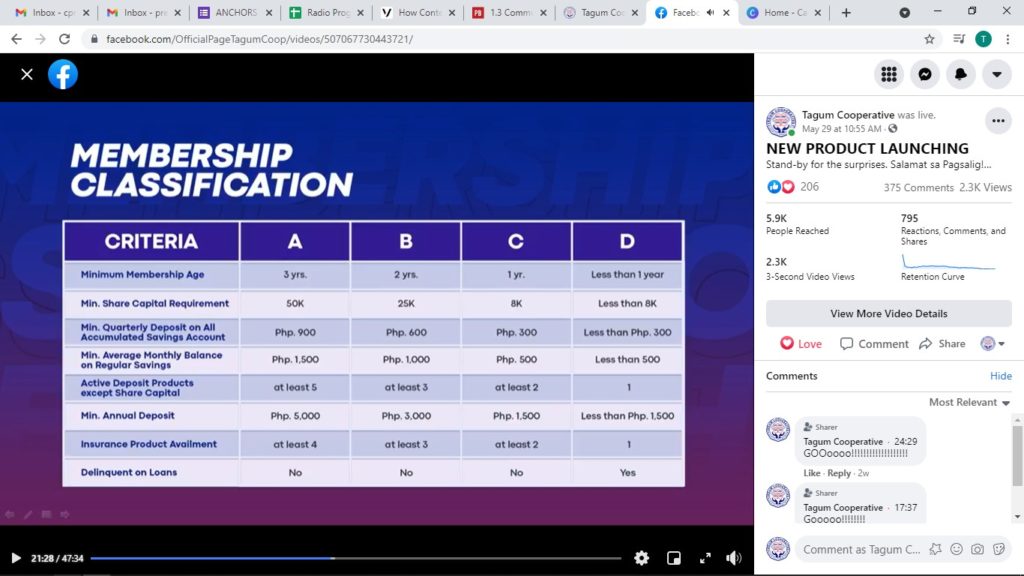

MEMBERSHIP CLASSIFICATION

Membership Classification motivates TC Members to constantly avail and support TC Products and Services. Striving to become Class A Members gives them the satisfaction by having privileges only Class A members can avail.

“Ensuring Tagum cooperatives sustainability is a two-way process. All the efforts and dedication shown by TC Officers, Management and Staff shall be parallel with members’ loyalty through our enhanced membership classification.” States Ms. Judelyn A. Sanchez, TC’s Chief Finance and Administration Officer.

Members can now level-up into a more premium classification, wherein the members will enjoy more perks and benefits as a return for holistically patronizing TC Products and Services.

Tagum Cooperative being an ACCESS and FOCCUS Branded Cooperative is committed to continuously provide excellent customer service to its members through its innovative and tailored-fit products and services. For more information members may visit the nearest Tagum Cooperative branches from Regions X to XIII or they may visit Tagum Cooperative online at www.tagumcooperative.coop or TC’s official Facebook page (OfficialPageTagumCoop).