Christmas comes early for Tagum Cooperative (TC) members as Fund Transfer to Other Accounts is made available in the mobile application!

Initially members are allowed to transfer funds from their Regular Savings or ATM account to their other savings account. This allowed members to transfer funds to their Birthday, Christmas, Vacation and other specialized savings accounts.

Now, fund transfer allows members to transfer funds from their deposit account to any member’s deposit account without any hassle. Source of fund should still come from a member’s Regular Savings or ATM Account. Limit per transaction is P10,000.00.

For security purposes, fund transfer requires a One-Time Password (OTP) which is being sent to member’s registered mobile number. Hence, members are encouraged not to share their account credentials and always update their contact information in the membership profile.

“We do not want to stop on a single feature when it comes to our mobile app, we always want to do better. With the current situation, this encourages members to stay in the comfort of their own homes without having to go anywhere. They do not have to have a face-to-face transaction with their fellow member.” TC Chief Operating Officer, Ms. Vivelyn D. Fronteras states.

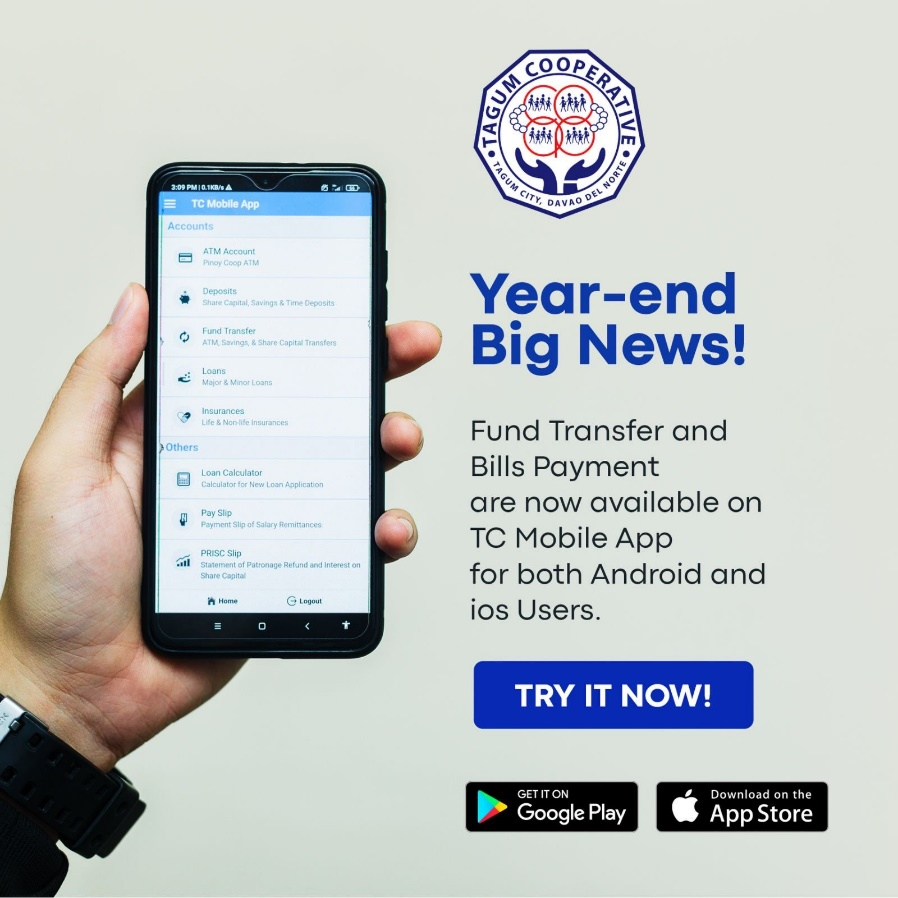

Multi-billion, multi-awarded Tagum Cooperative introduced the TC Mobile App in 2017 and since then, it has come a long way. From viewing current deposits, to loan applications, bills payment and now another one of the most-awaited features can be accessed in the comfort of its members’ own homes. In August 2020, TC Mobile App released its Bills Payment Feature which allows members to pay for their electric utilities, credit cards and water utilities among others. Members can also avail of certain minor loans on their mobile app in a hassle-free application. Once approved, the cash will be deposited to their savings / atm accounts.

TC Mobile App is available for free at App Store for iOS users and Play Store for Android Users.